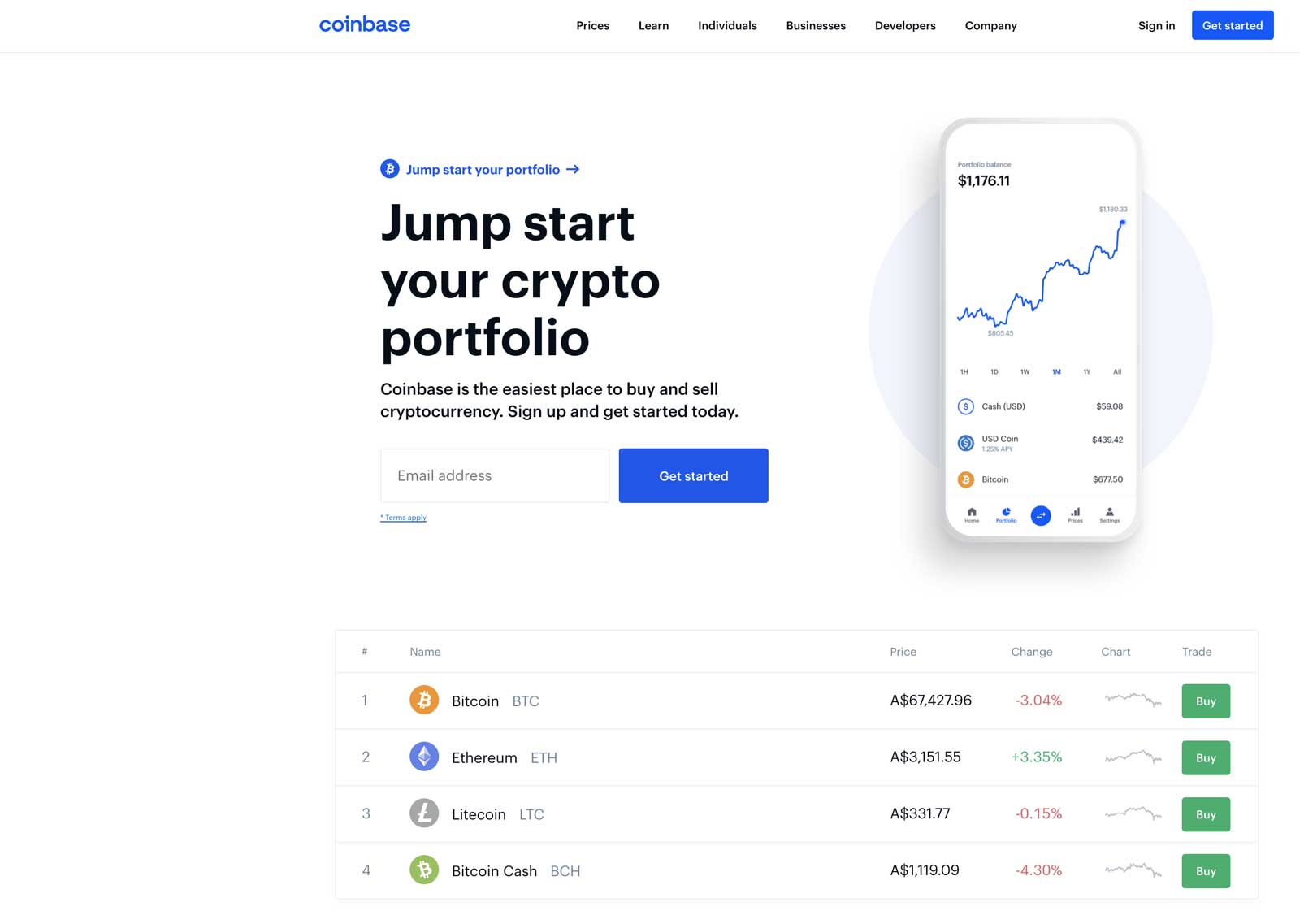

Coinbase Global Inc. was valued at $85 billion in its market debut this week and was greeted with some considerable fanfare.

Coinbase provides an exchange for bitcoin and about 50 other cryptocurrencies, and it is already recording significant profits—something unusual for newly traded tech-centric companies. It has a solid, established business with 1000 employees and over 56 million customers across 100 countries—but only as long as bitcoin and other cryptocurrencies are perceived as genuine assets by a rich enough following of investors.

For cryptocurrencies, Coinbase’s coming out was characterized as a sector defining experience similar to Netscape’s 1995 IPO for internet businesses. In recent months, the Bank of New York Mellon announced it would treat bitcoin like other assets, Goldman Sachs, J.P. Morgan and Morgan Stanley are in various stages of acceptance, and billionaires Elon Musk and Norway’s Kjell Inge Rokke announced investments in bitcoin.

However, this could all evaporate like the Dutch tulip bulb craze in the early 1600s, because bitcoin cannot deliver on its most fundamental promise—to supplant or exist along side greenbacks as money for everyday purchases.

Bitcoin is terribly expensive to use.

Transactions are validated on a blockchain simultaneously maintained by a network of miners. Individual miners earn the right to record a payment and movement of bitcoin among users by solving complex mathematical puzzles—that’s an expensive process because it uses a lot of computing power and energy.

According to BitInfoCharts, since the beginning of this year the average transaction fee has varied between $5.55 and $31.48. Why would anyone pay $10.00 to purchase a $4 latte at Starbucks with bitcoin?

In addition, the IRS and accounting profession treat bitcoin as a financial asset. For each transaction, the capital gain/loss against the original dollar purchase price must be calculated for tax reporting. Corporate “cash” held in bitcoin is subject to fluctuations in value that must be reflected in end of year financial statements.

The intent of bitcoin’s creators was to bypass monetary authorities and banks to create an asset of lasting value and an alternative to fiat money. To ensure its limited supply and blockchain integrity, they created those expensive-to-solve, high-carbon-footprint mathematical puzzles. Those are even more fundamental to bitcoin than is the face of Caesar to fiat money and can’t be eliminated.

High transactions and carbon costs are here to stay.

An electronic dollar, similar to the digital yuan China is introducing, could cut out the banks and would be vastly more efficient to use, financially and environmentally, than conventional fiat money and bitcoin. It would eliminate those expensive credit and debit card swipe fees that enrich banks and could be validated without mathematical puzzles and blockchain.

Should the Federal Reserve and the Treasury decide that China’s digital currency is a threat to the global supremacy of the dollar, stop blindly protecting the banks exclusive franchise in validating most everyday transactions and issue digital dollars, those would provide a securer, more stable and much less costly venue for transferring funds among households and businesses than bitcoin’s network of blockchain computers.

As assets, the good and services the U.S., Chinese and European economies produce stand behind the dollar, yuan and euro—there is no Bitland making stuff.

As assets, the phones and automobiles produced and their potential profitability stand behind the stock values for Apple and Tesla—there are no BitPhones or BitCars.

Bitcoin is somewhat like digital art—lines of ones and zeros but you can’t look at bitcoin or gain any visual pleasure from it.

Sooner or later environmentalist and the progressive media will take aim at bitcoin’s growing carbon footprint and make owing cryptocurrencies terribly unwoke. Then how would billionaires owning bitcoin show up at the World Economic Forum.

Perhaps they would be called out by corporate keepers of moral purity, Coca Cola, American Airlines and cabal of progressive appeasing CEOs.

Don’t take solace in the fact that big banks are permitting customers to invest in bitcoin. Experiences with derivatives and junk bonds indicates their penchant for profits will let them hawk rich folks some pretty questionable stuff.

In fact, investing in bitcoin is more like playing Monopoly with real money. Everyone agrees to bid with dollars for the fixed supply of game money, but what happens when the players find a new novelty?

The popularity of Monopoly and other board games persisted for decades but declined dramatically when computers offered children aliens to slay.

At any time, Messrs. Musk and Rokke could find a new way to gadfly attention with their investors’ money.

At least tulip bulbs could be planted for flowers.