Ensure your collection is well-documented.

I was reading my latest edition of the Intelligent Collector (Fall, 2016) the other day and came across an article on the collections in estates by Halperin, Rohan, and Prendergast and it reminded me of a close friend of mine who has a huge collection of very valuable coins and stamps that are only organized in a system that makes sense to him and valued as well only by him. The good news is that he has made arrangements through his will to have these collections valued by experts he knows and disposed of as benefits his beneficiaries.

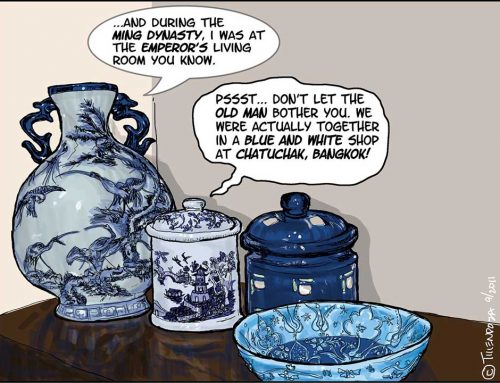

All too often I see or hear of the exact opposite condition for estates that contain collections that baffle the beneficiaries and executors. Most of us have collected things over the years that have value to us, either sentimental or monetary (sometimes both). Just as important is realizing that what interests you may not interest your heirs and certainly your heirs do not have your knowledge of the details and history of your collection.

What do we do to ensure that the collections and the items in them are treated properly and benefit those to whom we leave them? (I am making the assumption that each person reading this has been sensible enough and cares about his or her family enough to have made a will)

Here are a few of my thoughts and those of the authors to help you with this.

- Make a complete inventory of your collection, with comments about each item that describes it and how you acquired it. This is particularly important for family heirlooms whether or not they have a high monetary value. Record, as part of your will, where this inventory is kept.

- What is the monetary value of the inventory? This is not what you think it is worth, has it been appraised and if so, how current is the appraisal? Too often I find the owner has grossly overvalued the collection ether because of his ignorance or because he has been overly optimistic how much a purchased item will increase in value over time. But even if your collection is valuable, let people know so that they will not be victims of scams that purchase the items from the estate at a greatly discounted amount and cheat your beneficiaries of their inheritance.

- As part of your collection, do you have items borrowed from someone else or stored for someone? Make it clear which items are yours and which belong to another party.

- Do you know if your collection will be desired by your beneficiary? All too often now, I find that our children and grandchildren have no little or no interest in the family heirlooms that we treasure. As an example, in my own situation, I wonder if my grandson will really have any interest in my grandfather’s pocket watch, when he relies on his mobile phone to tell him the time.

- If you are going to dispose of your collection or recommend that your estate do so, who are you going to choose to do so and what will be the costs of disposing of it?

- Do you intend to continue to collect? If so, make sure that your inventory is current and complete

As a final sidebar, let me caution you about your acquisitions. Just two weeks ago, a client was telling me about her brother, who over his adult life time invested in firearms, thinking they would be his retirement. Coming close to retirement, the man wanted to start liquidating his investment and found that they had not only failed to increase in value, but now realized less than he had actually paid for them years ago.

I see this same thing often with “collectible” coins. When collecting as an investment, please get the advice and counsel of someone knowledgeable in that particular specific area and do your own research by following what items are selling well at reputable auction houses and dealers. Please do not rely solely on the advice of the person selling the item. Merely investing in something because it is “antique” or “collectible” or “limited edition” without expert advice and careful research is too often a recipe for later disappointment.

For a more detailed treatment of this topic, I recommend The Collector’s Handbook: Tax Planning, Strategy and Estate Advice for Collectors and Their Heirs by Halperin and Rohan with Prendergast. Ivy Press